Property Law Services

Your first home – or your retirement home – or the number in between – the stress is still the same.

The idea of shifting, packing, arranging phones/internet etc can be daunting – and those matters don’t even involve the paperwork!

That’s where we can help. You may have already organised your finance with a Broker or the Bank.

You may have organised a real estate agent and signed an offer to purchase (or sell) – it will be at this point you think – “what now”.

Buying or selling a house? Trust KJ Law for Property Matters.

Our Services

KJ Law provides a legal services package (whether buying or selling a house) which can include:

- Advice on the agreement prior to signing;

- Advice on terms such as the Builders report, Land Information Report, Meth/Toxicology Report, Title to the property (whether cross-lease/unit or freehold), structure for ownership (whether joint ownership or in shares);

- Extension of contract terms (if necessary) or negotiations for changes; Review of all finance documentation and its requirements and implications;

- Drafting of all documents for transfer, settlement, mortgages, guarantees (if any), signing and providing all information for the final settlement;

- Meetings with you and advising on the process.

Fees

Our fees for services are basically fixed depending on your transaction. We set our fees based on your needs. Ring us for an estimate of the fees which apply for your matter. We are a small team, which also makes it more personal to you.

You become a member of that team which is the most important part of our services.

We have a wealth of experience among our staff members – some having attended to conveyancing matters for 20 + years. So – if you attend to the household matters like mail re-direction and phone connections – we’ll assist you with the rest.

That is our job – and no doubt that will alleviate some of your stresses.

How we Assist you

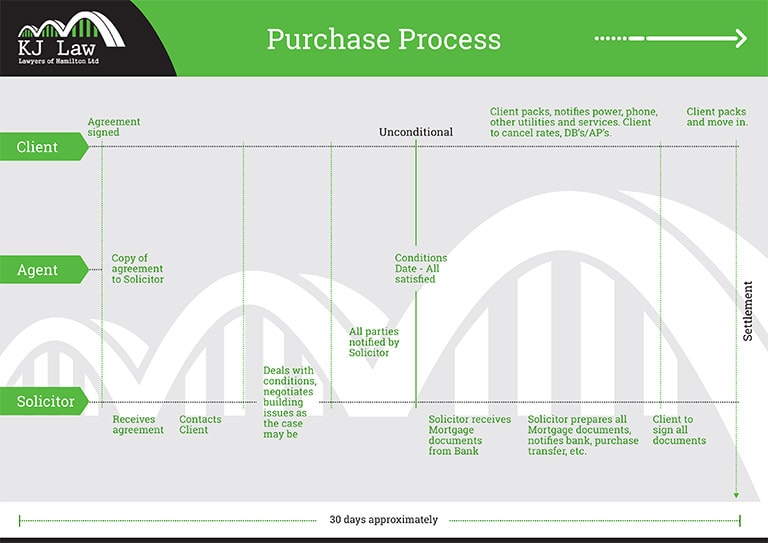

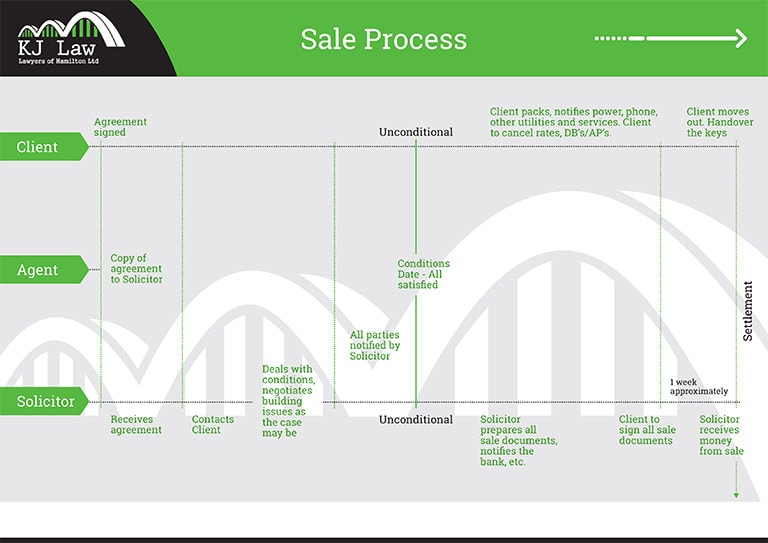

To assist YOU in this process we added the Sales Flow Diagram and a Purchase Flow Diagram below which sets out the basic tasks and people involved in your transaction.

This will give YOU details on the “what, when and WHO”. Give us a call to help YOU – we can.

Did you know:

1. Every transfer being registered in New Zealand MUST record the NZ IRD number of the seller and the Buyer. Do you have a NZ IRD number?

2. From 1 July 2016 every overseas seller must now comply with the new RLWT (Residential Land Withholding Tax) requirements – see RLWT Tax form below.

Did you know

Every transfer being registered in New Zealand MUST record the NZ IRD number of the seller and the Buyer. Do you have a NZ IRD number?

From 1 July 2016 every overseas seller must now comply with the new RLWT (Residential Land Withholding Tax) requirements – see RLWT Tax form below.